Plethora Private Equity is a Netherlands-based fund focused on exploring for the metals driving the energy transition in Europe and North America.

Current supply of the metals needed for electric vehicles and the renewables sector (primarily copper, nickel and lithium) are extracted in jurisdictions that can be problematic on social, geopolitical, and environmental issues.

The (non-geological) reasoning behind our constricted focus on safe jurisdictions are:

- The upholding of legal ownership in the jurisdictions where we operate

- The highest standards on environmental and social impact

- The ongoing de-globalisation trend, kick-started by Covid and accelerated by geopolitical developments

As we firmly believe mining starts at the exploration phase we actively screen potential mineral exploration targets on social and environmental impact.

We are making sure our exploration is done in a responsible way, according to the latest environmental standards, and outside of e.g. Natura 2000 areas. We minimize impact through active engagement and collaboration with local communities. We have a dedicated sustainable development officer in our team that takes the lead on this.

Over the past six years, we have invested over €16 million on mineral exploration in Europe and North-America, financed by a group of sixty, mainly Dutch, private investors.

Mineral exploration is an important, but forgotten, link in the energy transition:

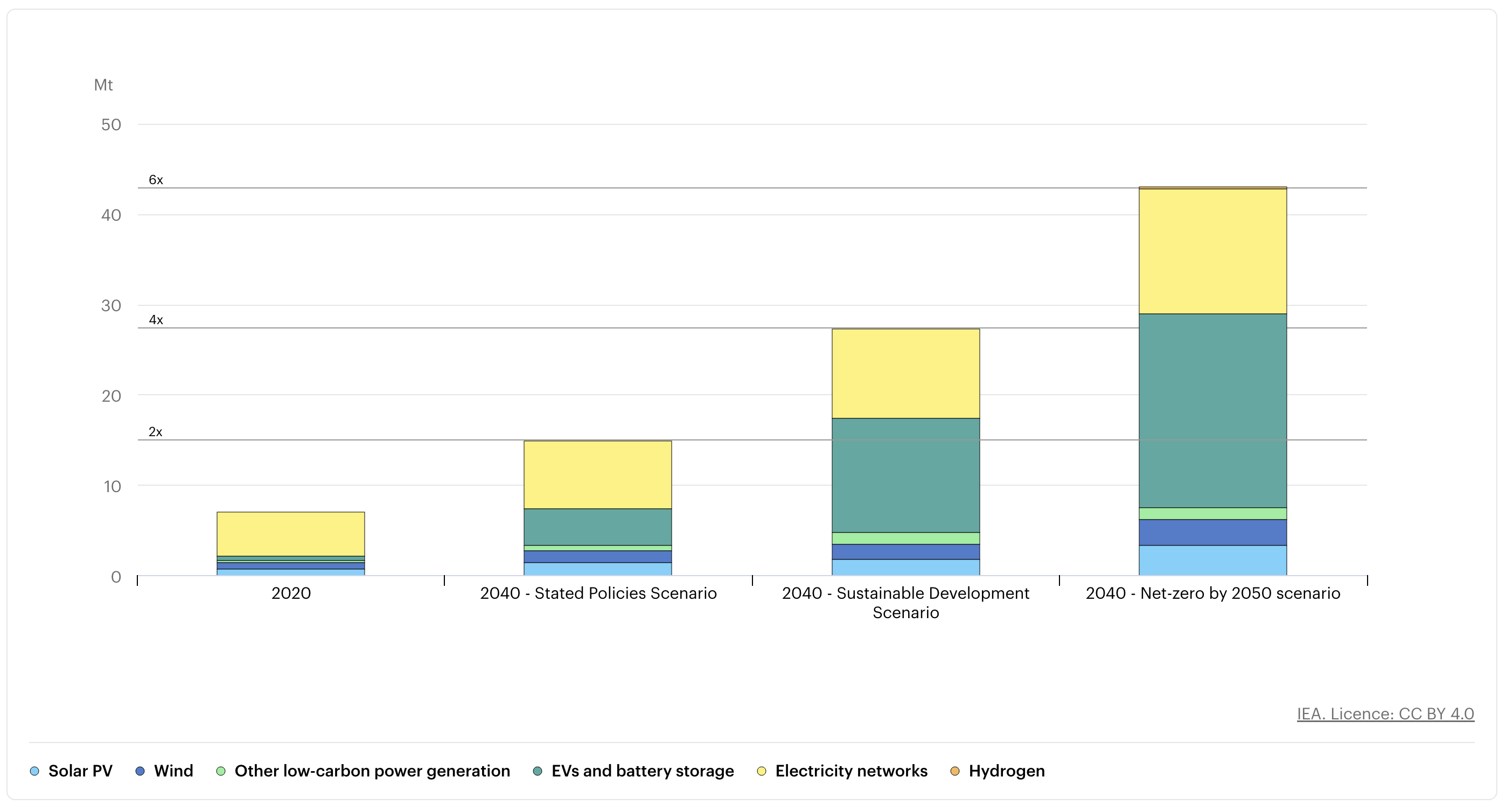

Source: IEA: total mineral demand for clean energy technologies by scenario, 2020 compared to 2040

See the Strategy page, the Information Memorandum and the Essential Information Document for further information.

Sustainable Finance Disclosure Regulation (SFDR)

As per 10 March 2021 the EU Sustainable Finance Disclosure Regulation (SFDR) has come into force. In the context of the Sustainable Finance Disclosure Regulation (SFDR), the Fund has been classified as an Article 6 fund.

The investments of Plethora Private Equity do not take into account the EU criteria for environmentally sustainable economic activities. However, in compliance with the SFDR, the Fund Manager does consider the effects of material sustainability risks on the value of the Fund’s investments. On a company by company basis, all relevant ESG/sustainability risks are being defined and assessed during the initial due diligence but also on an ongoing basis after an investment is made.

In accordance with the SFDR and the Taxonomy Regulation, the Fund Manager is required to provide information regarding sustainability concerning the Fund. This section provides the necessary information regarding the Fund.

Qualification of the Fund

The Fund qualifies under Article 6 of SFDR. It does not promote environmental or social characteristics (‘light green investments’ as referred to in Article 8 of SFDR) and also does not have sustainable investment as its objective (‘dark green investments’ as referred to in Article 9 of SFDR). The underlying investments of this financial product do not take into account the EU criteria for environmentally sustainable economic activities.

Policy on sustainability risks

The Fund Manager acknowledges that the realization of sustainability risks can potentially have a negative impact on the value of investments. A sustainability risk, in essence, refers to an event in the environmental, social, or governance (ESG) domain that could adversely affect the value of the Units. Sustainability risks in the environmental domain, for instance, encompass issues like CO2 emissions, energy consumption, and biodiversity loss. On the social front, sustainability risks might pertain to product liabilities and the respect of human rights. In the case of governance-related sustainability risks, considerations could involve inclusivity, diversity, compensation, and corporate ethics. The Fund Manager integrates sustainability risks to a limited extent in investment decisions.

Unfavourable effects of investment decisions on sustainability factors not considered

The Fund Manager does not consider the adverse effects of investment decisions on sustainability factors and therefore does not annually prepare a so-called Principal Adverse Sustainability Impact statement (PAI). Taking into account the adverse effects of investment decisions on sustainability factors would require the Fund Manager to report on this matter. The necessary information for reporting is currently not available within the Fund Manager. Obtaining such information would necessitate the Fund Manager to undertake (costly) measures. The Fund Manager considers this to be disproportionate, especially since investors are not expected to attach significance to a PAI. The foregoing does not preclude the Fund Manager from reconsidering the decision not to account for adverse effects of investment decisions on sustainability factors, should relevant circumstances arise. For instance, if the majority of investors request a PAI.

Sustainability risks and remuneration policy

Under the AIFMD registration regime, the Fund Manager is not obligated to adhere to the legally prescribed remuneration policy. Given the limited size of the organization, it was decided not to (voluntarily) establish a specific remuneration policy. Due to the absence of (an obligation to establish) a remuneration policy, the SFDR requirement regarding the provision of information about the remuneration policy and the extent to which that policy aligns with sustainability risks does not apply to the Fund Manager.